ESG Disclosure: Confusion to Convergence

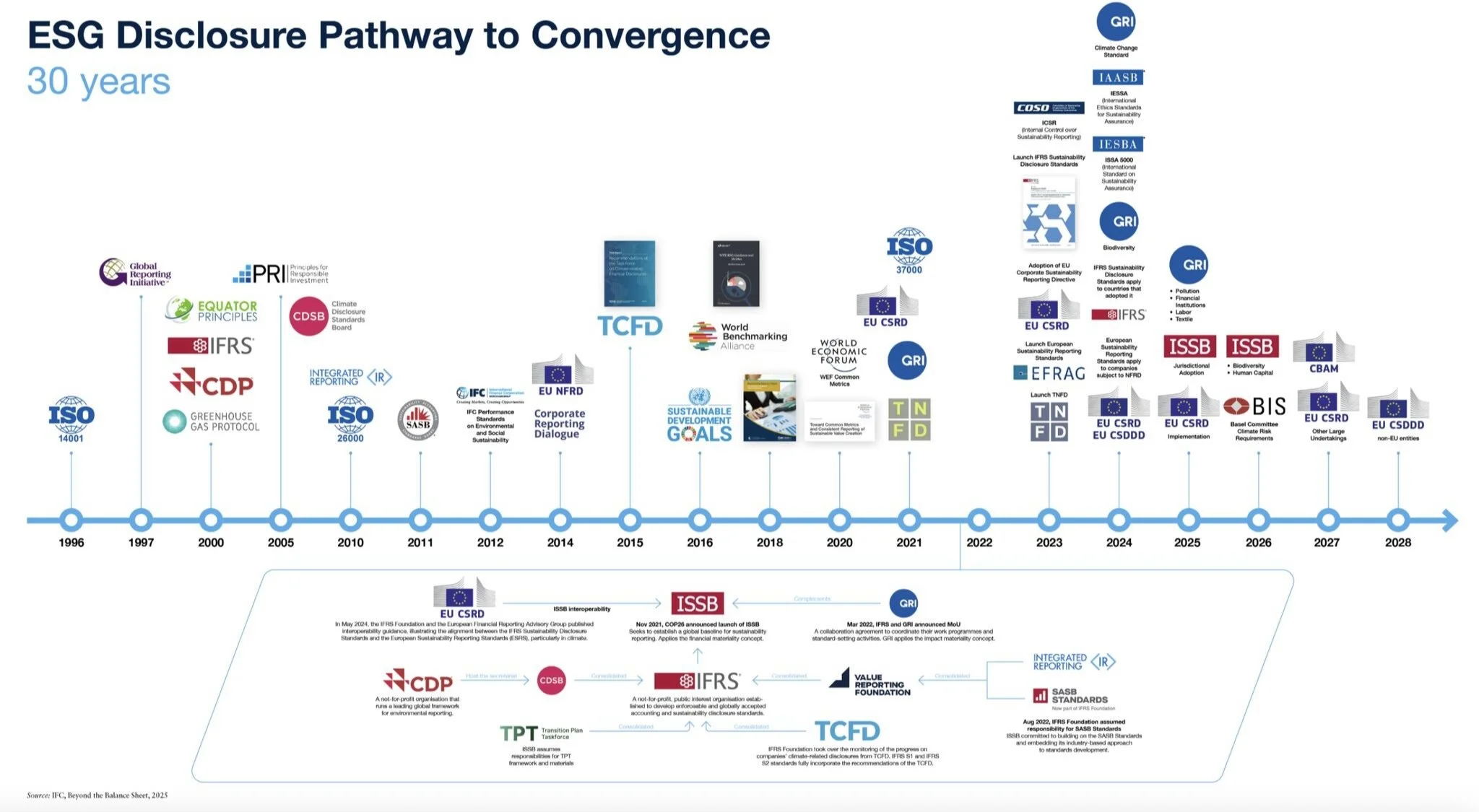

For years, organisations have been navigating a maze of sustainability reporting frameworks. CDP, GRI, SASB, TCFD, EU CSRD, ISSB… the acronyms pile up, and it’s no wonder that many boards feel lost in a sea of competing requirements.

The good news? The tide is turning. After 30 years of parallel initiatives, sustainability disclosure is now on a clear pathway to convergence.

How We Got Here

In the 1990s and early 2000s, sustainability reporting was led by voluntary initiatives like the Global Reporting Initiative (GRI) and CDP. These gave organisations a way to talk about their environmental and social impact, but there was no consistency, and investors struggled to compare performance across companies.

The 2010s brought more structure:

• SASB introduced sector-specific standards.

• Integrated Reporting pushed for connecting sustainability to financial value.

• TCFD made climate risk disclosures mainstream.

• The UN Sustainable Development Goals added a global framing for impact.

The result? A crowded and fragmented reporting landscape.

The Convergence Moment

Today, momentum is firmly towards alignment:

• The ISSB (International Sustainability Standards Board), under the IFRS umbrella, is building a global baseline for investor-focused sustainability reporting.

• The EU CSRD (Corporate Sustainability Reporting Directive) is making disclosure mandatory across Europe, in close alignment with ISSB.

• GRI continues to cover broader impacts for stakeholders beyond investors.

• And crucially, ISO is embedding sustainability into management systems and assurance frameworks that organisations already use worldwide.

Together, these frameworks are beginning to “speak the same language”.

ISO: The Missing Link

While ISSB and CSRD define what to disclose, ISO standards shape how organisations actually deliver on those commitments.

• ISO 14001 (environmental management) and ISO 50001 (energy management) already guide thousands of organisations globally.

• In 2023, ISO launched ISO 14068 on greenhouse gas management and carbon neutrality claims.

• ISO is aligning its standards with the ISSB baseline, creating a bridge between operational management and global disclosure.

This matters because:

1. ISO connects day-to-day sustainability practices with the high-level disclosures investors and regulators demand.

2. ISO certification brings third-party assurance — strengthening the credibility of ESG reports.

3. ISO standards have global recognition, embedding convergence into business operations, not just reporting.

Why This Matters for Estates and Heritage Organisations

For landowners, councils, and heritage bodies, this shift means:

• Less duplication: a core set of disclosures that meet multiple requirements.

• Clearer investor signals: finance providers increasingly rely on ISSB-aligned data.

• More credibility: ISO-backed assurance strengthens trust with communities, regulators, and funders.

In practice, an estate already certified to ISO 14001 can integrate those systems with ISSB or CSRD reporting, creating a seamless loop:

Measure → Manage → Disclose → Assure.

Our Take at Resilient Horizons

At Resilient Horizons, we see convergence as an opportunity. Organisations that get ahead of the curve will:

• Avoid last-minute compliance scrambles.

• Build stronger cases for green finance and grants.

• Show leadership in a crowded sustainability landscape.

Our role is to help you translate the alphabet soup of ESG into clear, practical actions that fit your context- whether you’re a heritage estate, a local council, or a forward-looking SME.